中华人民共和国耕地占用税法(中英文对照版)

《中华人民共和国耕地占用税法》已由中华人民共和国第十三届全国人民代表大会常务委员会第七次会议于2018年12月29日通过, 现予公布,自2019年9月1日起施行。

法律文本

中华人民共和国耕地占用税法

Law of the People's Republic on Cultivated Land Occupation

主席令第十八号

Presidential Decree No. 18

《中华人民共和国耕地占用税法》已由中华人民共和国第十三届全国人民代表大会常务委员会第七次会议于2018年12月29日通过, 现予公布,自2019年9月1日起施行。

The Law of the People's Republic of China on Cultivated Land Occupation Tax, adopted at the 7th session of the Standing Committee of the 13th National People's Congress of the People's Republic of China on December 29, 2018, is hereby promulgated, effective September 1, 2019.

中华人民共和国主席 习近平

President Xi Jinping

2018年12月29日

December 29, 2018

(2018年12月29日第十三届全国人民代表大会常务委员会第七次会议通过)

(Adopted at the 7th session of the Standing Committee of the 13th National People's Congress on December 29, 2018)

第一条 为了合理利用土地资源,加强土地管理,保护耕地,制定本法。

Article 1 This Law is enacted in order to make rational use of land resources, strengthen land administration and protect cultivated land.

第二条 在中华人民共和国境内占用耕地建设建筑物、构筑物或者从事非农业建设的单位和个人,为耕地占用税的纳税人,应当依照本法规定缴纳耕地占用税。

Article 2 Organisations and individuals that occupy arable land in the People's Republic of China to construct buildings and structures or to engage in non-agricultural development projects shall be taxpayers of arable land occupation tax, and shall pay arable land occupation tax pursuant to the provisions of this Law.

占用耕地建设农田水利设施的,不缴纳耕地占用税。

The occupation of farmland for the construction of irrigation and water conservancy facilities shall not be subject to farmland occupation tax.

本法所称耕地,是指用于种植农作物的土地。

For purposes of this Law, cultivated land means land used for growing crops.

第三条 耕地占用税以纳税人实际占用的耕地面积为计税依据,按照规定的适用税额一次性征收,应纳税额为纳税人实际占用的耕地面积(平方米)乘以适用税额。

Article 3 The occupation tax on cultivated land shall be calculated on the basis of the actual area occupied by the taxpayer and shall be subject to a one-time levy in the specified applicable tax amount. The payable tax amount shall be the area of the cultivated land actually occupied by the taxpayer (in square meters) multiplied by the applicable tax amount.

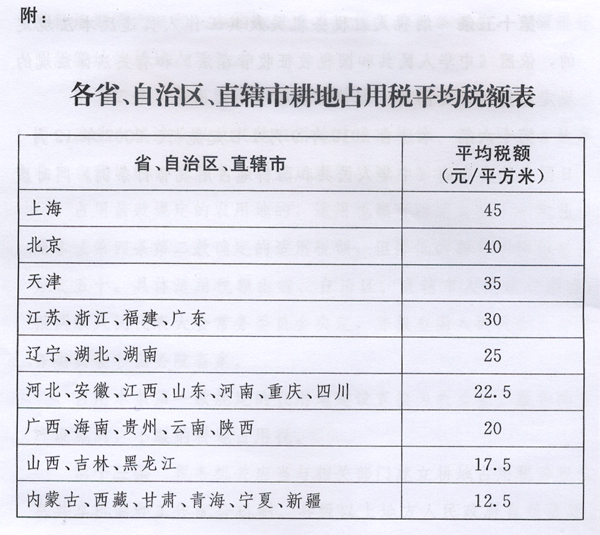

第四条 耕地占用税的税额如下:

Article 4 The amounts of the occupation tax for cultivated land shall be as follows:

(一)人均耕地不超过一亩的地区(以县、自治县、不设区的市、市辖区为单位,下同),每平方米为十元至五十元;

1. CNY10 to 50 per m2 in places where the per capita area of cultivated land is not more than one mu (a county, an autonomous county, a city not divided into districts or a municipal district shall be hereinafter regarded as a unit).

(二)人均耕地超过一亩但不超过二亩的地区,每平方米为八元至四十元;

2. CNY8 to 40 per m2 in places where the per capita area of cultivated land is between one and two mu; and

(三)人均耕地超过二亩但不超过三亩的地区,每平方米为六元至三十元;

(III) CNY6 to 30 per m2 in places where the per capita area of cultivated land is between 2 and 3 mu.

(四)人均耕地超过三亩的地区,每平方米为五元至二十五元。

(IV) CNY5 to 25 per square meter in places where the per capita area of cultivated land is more than three mu.

各地区耕地占用税的适用税额,由省、自治区、直辖市人民政府根据人均耕地面积和经济发展等情况,在前款规定的税额幅度内提出,报同级人民代表大会常务委员会决定,并报全国人民代表大会常务委员会和国务院备案。各省、自治区、直辖市耕地占用税适用税额的平均水平,不得低于本法所附《各省、自治区、直辖市耕地占用税平均税额表》规定的平均税额。

The applicable tax amount for occupation of cultivated land in each region shall be proposed by the people's government of the province, autonomous region or municipality directly under the Central Government within the tax amount range as stipulated in the preceding paragraph based on the circumstances such as the per capita area of cultivated land and economic development, and shall be reported to the standing committee of the people's congress at the same level for determination and to the Standing Committee of the National People's Congress and the State Council for filing. The average of applicable amounts of the cultivated land occupation tax of a province, autonomous region or municipality directly under the Central Government shall not be lower than the average tax amount stipulated in the Average Tax Amounts of cultivated land occupation Tax of Provinces, Autonomous Regions and municipalities directly under the Central Government attached hereto.

第五条 在人均耕地低于零点五亩的地区,省、自治区、直辖市可以根据当地经济发展情况,适当提高耕地占用税的适用税额,但提高的部分不得超过本法第四条第二款确定的适用税额的百分之五十。具体适用税额按照本法第四条第二款规定的程序确定。

Article 5 In regions where the per capita area of cultivated land is less than 0.5 mu, the provinces, autonomous regions and municipalities directly under the Central Government may increase the applicable tax amount for the occupation of cultivated land by an appropriate amount based on the local economic development situation; however, the increased amount shall not exceed 50% of the applicable tax amount as determined in Paragraph 2 of Article 4 of this Law. The specific applicable tax amounts shall be determined pursuant to the procedures stipulated in the second paragraph of Article 4 of this Law.

第六条 占用基本农田的,应当按照本法第四条第二款或者第五条确定的当地适用税额,加按百分之一百五十征收。

Article 6 Any unit and individual that occupy and use basic farmland shall pay an additional 150 percent of the local applicable tax as determined in the second paragraph of Article 4 or Article 5 of this Law.

第七条 军事设施、学校、幼儿园、社会福利机构、医疗机构占用耕地,免征耕地占用税。

Article 7 The occupation of cultivated land by military facilities, schools, kindergartens, social welfare institutions and medical institutions shall be exempted from cultivated land occupation tax.

铁路线路、公路线路、飞机场跑道、停机坪、港口、航道、水利工程占用耕地,减按每平方米二元的税额征收耕地占用税。

The farmland occupied by railways, highways, airport runways, aprons, harbors, waterways and water conservancy projects shall be subject to farmland occupation tax at a reduced tax rate of CNY2 per square meter.

农村居民在规定用地标准以内占用耕地新建自用住宅,按照当地适用税额减半征收耕地占用税;其中农村居民经批准搬迁,新建自用住宅占用耕地不超过原宅基地面积的部分,免征耕地占用税。

Where rural residents use arable land to build new residential housing for their own use within the stipulated land use standards, arable land occupation tax shall be levied at half the local applicable tax amount; in the event that rural residents have obtained approval for relocation, the portion of arable land occupied by newly built residential housing for their own use which does not exceed the area of the original residential land shall be exempted from arable land occupation tax.

农村烈士遗属、因公牺牲军人遗属、残疾军人以及符合农村最低生活保障条件的农村居民,在规定用地标准以内新建自用住宅,免征耕地占用税。

The farm land occupation tax shall be exempted for the building of new houses for self-use by the dependents of rural martyrs, of military personnel who sacrificed in action, of disabled military personnel and of rural residents meeting the minimum living security conditions in rural areas within the prescribed standards for land use.

根据国民经济和社会发展的需要,国务院可以规定免征或者减征耕地占用税的其他情形,报全国人民代表大会常务委员会备案。

The State Council may stipulate other circumstances for exemption or reduction of arable land occupation tax based on the needs of national economic and social development and file records with the Standing Committee of National People's Congress.

第八条 依照本法第七条第一款、第二款规定免征或者减征耕地占用税后,纳税人改变原占地用途,不再属于免征或者减征耕地占用税情形的,应当按照当地适用税额补缴耕地占用税。

Article 8 In the event that the taxpayer changes the use of the occupied cultivated land and reduction or exemption is no longer applicable due to that change, the taxpayer must pay the amount reduced or exempted under Paragraphs 1 and 2 of Article 7.

第九条 耕地占用税由税务机关负责征收。

Article 9 Cultivated land occupation tax shall be collected by tax authorities.

第十条 耕地占用税的纳税义务发生时间为纳税人收到自然资源主管部门办理占用耕地手续的书面通知的当日。纳税人应当自纳税义务发生之日起三十日内申报缴纳耕地占用税。

Article 10 The tax payment obligation for farmland occupation tax arises on the date when a taxpayer receives a written notice on going through the formalities for farmland occupation from the competent department of natural resources. A taxpayer shall declare and pay the occupation tax on cultivated land within 30 days as of the date when the tax obligation arises.

自然资源主管部门凭耕地占用税完税凭证或者免税凭证和其他有关文件发放建设用地批准书。

The department in charge of natural resources shall issue an approval document for construction land use based on the receipt of farmland occupation tax or tax-free certificate and other relevant documents.

第十一条 纳税人因建设项目施工或者地质勘查临时占用耕地,应当依照本法的规定缴纳耕地占用税。纳税人在批准临时占用耕地期满之日起一年内依法复垦,恢复种植条件的,全额退还已经缴纳的耕地占用税。

Article 11 A taxpayer temporarily occupying cultivated land due to construction projects or geological surveys shall pay cultivated land occupation tax in accordance with this Law. The farmland occupation tax already paid shall be refunded in full if the farmland is recultivated by the taxpayer in accordance with the law within one year from the date of approval for temporary occupation of the farmland.

第十二条 占用园地、林地、草地、农田水利用地、养殖水面、渔业水域滩涂以及其他农用地建设建筑物、构筑物或者从事非农业建设的,依照本法的规定缴纳耕地占用税。

Article 12 For the occupation of garden land, forest land, grassland, land for farmland water conservancy, aquaculture waters, tidal flats of fishery waters and other farmland for construction of buildings and structures or for non-agricultural construction, the occupation tax on cultivated land shall be paid in accordance with the provisions hereof.

占用前款规定的农用地的,适用税额可以适当低于本地区按照本法第四条第二款确定的适用税额,但降低的部分不得超过百分之五十。具体适用税额由省、自治区、直辖市人民政府提出,报同级人民代表大会常务委员会决定,并报全国人民代表大会常务委员会和国务院备案。

For occupation and use of agricultural land stipulated in the preceding paragraph, the applicable tax amount may be reasonably lower than the applicable tax amount determined in the locality pursuant to the provisions of the second paragraph of Article 4 of this Law, provided that the reduced amount shall not exceed 50%. The specific applicable tax amounts shall be proposed by the People's Government of the province, autonomous region or centrally-administered municipality, submitted to the Standing Committee of the People's Congress at counterpart level for decision, and filed with the Standing Committee of the National People's Congress and the State Council.

占用本条第一款规定的农用地建设直接为农业生产服务的生产设施的,不缴纳耕地占用税。

Occupation of agricultural land stipulated in the first paragraph of this Article to construct production facilities which serve agricultural production directly shall not be subject to arable land occupation tax.

第十三条 税务机关应当与相关部门建立耕地占用税涉税信息共享机制和工作配合机制。县级以上地方人民政府自然资源、农业农村、水利等相关部门应当定期向税务机关提供农用地转用、临时占地等信息,协助税务机关加强耕地占用税征收管理。

Article 13 The tax authorities shall establish a tax-related information sharing mechanism and work cooperation mechanism with the relevant departments for occupation tax on cultivated land. The natural resources, agricultural and rural, water conservancy and other relevant departments of the local people's governments at or above the county level shall regularly provide the taxation authorities with the information on conversion of agricultural land, temporary occupation of land and other information and assist the taxation authorities in strengthening the administration of collection of occupation tax on cultivated land.

税务机关发现纳税人的纳税申报数据资料异常或者纳税人未按照规定期限申报纳税的,可以提请相关部门进行复核,相关部门应当自收到税务机关复核申请之日起三十日内向税务机关出具复核意见。

In the event that the tax authority discovers any abnormality in the tax declaration data of a taxpayer or a taxpayer fails to file tax returns within the prescribed time limit, the tax authority may request the relevant department to review. The relevant department shall issue review opinions to the tax authority within 30 days after receiving the review application of the tax authority.

第十四条 耕地占用税的征收管理,依照本法和《中华人民共和国税收征收管理法》的规定执行。

Article 14 The administration of collection of cultivated land occupation tax shall be subject to this Law and the Law of the People's Republic of China on the Administration of Tax Levying.

第十五条 纳税人、税务机关及其工作人员违反本法规定的,依照《中华人民共和国税收征收管理法》和有关法律法规的规定追究法律责任。

Article 15 Where taxpayers, tax authorities and their staff violate the provisions of this Law, they shall be held legally liable in accordance with the Law of the People's Republic of China on the Administration of Tax Levying and relevant laws and regulations.

第十六条 本法自2019年9月1日起施行。2007年12月1日国务院公布的《中华人民共和国耕地占用税暂行条例》同时废止。

Article 16 The Law shall come into force as of September 1, 2019. The Provisional Regulations of the People's Republic of China on Arable Land Occupation Tax promulgated by the State Council on 1 December 2007 shall be repealed simultaneously.

©本站文章、图片等内容知识产权归作者所有。本站所有内容均来源于网络,仅供学习交流使用!

转载请注明出处: 法总荟 » 中华人民共和国耕地占用税法(中英文对照版)

发表评论 取消回复